4. The lending company isn’t really entered on the state

If you’re considering a personal loan or want to take out a next personal bank loan, you can see Reliable to compare loan rates and lenders.

Loan providers are required to be registered into the for each state they do organization when you look at the. If a friends isn’t really entered on your state, upcoming giving you a personal loan is actually unlawful. If the a family isnt inserted in just about any condition, it .

To make sure you’re avoiding a personal loan scam, double-check with your state’s attorneys general’s work environment to see if the company is properly registered.

5. The lender connectivity your directly to supply the loan

Whenever you are a valid lender will get send you prescreened has the benefit of throughout the send since a form of offer, it will not get in touch with you straight to solicit your company. If you do located a pre-recognized or prescreened render – either in the form of a make sure that you could dollars – make sure you check out the post right here carefully comment the mortgage terminology and check around before you could bucks the view.

Contemplate, a genuine providers requires you to definitely submit a proper application detailed with individual and you can monetary pointers and would a credit score assessment.

six. The financial institution states zero credit assessment needs

If a lender says no credit check is required, proceed with caution. This could be a warning signal. Some high-cost lenders, like payday loan companies, waive credit checks but, in exchange, they charge a very high effective interest rate.

Tips tell if an unsecured loan organization is genuine

Including a loan provider getting registered on your state, you will want to work with such five factors to help you determine if the a lender is actually legit:

- Street address – A loan provider who may have zero street address otherwise one that uses a great P.O. box having a speech is just one that you ought to remove with suspicion. Genuine organizations often monitor the street address somewhere on the websites.

- Secure website – In the event your lender’s site isn’t shielded, this might be a sign that company isn’t really actual. You will find in the event that an internet site . is safe of the wanting new padlock from the browser’s address club.

- Better business bureau – You need to use the better Business Bureau to review a lender. In case the financial isn’t detailed or enjoys partners reviews, it would be a fake business.

- Take a look at on the internet reviews – Learning online reviews helps you rating a sense of exactly what anyone else check out the consumer loan bank. But when you cannot find people recommendations or perhaps the ones you carry out look for take a look suspect, this is often a sign to quit the lending company anyway can cost you.

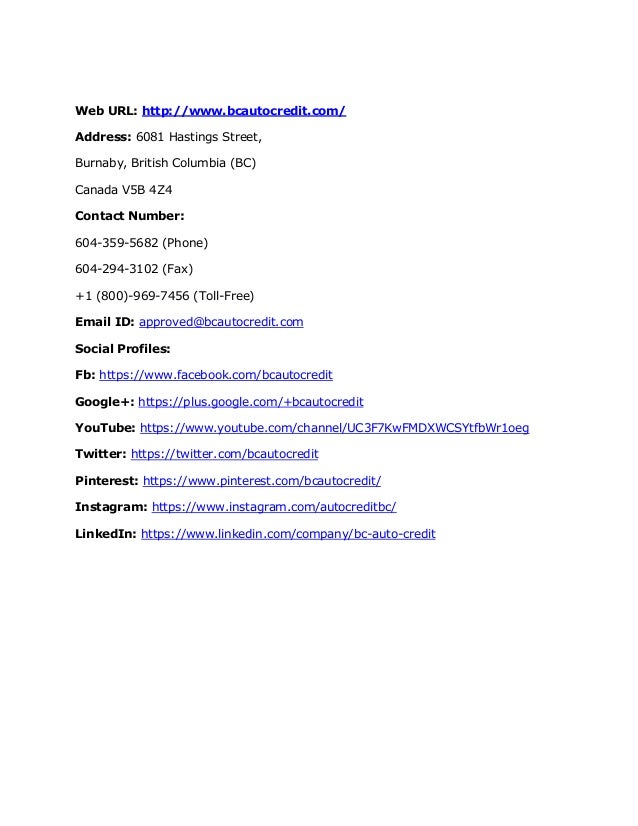

- Vet contact info – Pick an unknown number and name to verify it is a good actual organization. A lender that will not checklist one contact details on the the webpages have terrible customer service at best, and get a total con at worst.

What any time you would should you get scammed?

Bringing the procedures over helps you prevent scammers, nevertheless doesn’t get rid of the likelihood of con. If you feel you have been cheated, here’s what you can do:

- Collect research. Collect most of the facts you could think of. This can include one financing plans you signed, phone calls, emails, or emails you gotten regarding the post.

- Document an authorities statement. Contact your regional cops agencies to file a research. Keep a duplicate of this statement since you need they doing even more measures.

- File a report with the proper agencies. In addition to filing a police report, you should file a report with other agencies by visiting , the Consumer Monetary Protection Agency, and your nation’s attorney general’s work environment. Some of these agencies may be able to help you get some of your funds back or recover from identity theft.